The Tally.ERP 9 Setup screen is displayed as shown. Figure 2.3 Tally.ERP 9 Setup 5. In Tally.ERP 9 Setup screen, you may accept the default directories or click on the buttons provided to change the path of Application Directory, Data Directory, Configuration Directory, Language Directory or License Directory respectively. This Telugu version book offers you in-depth knowledge about how to work with Tally.ERP 9 in a precise and easy-to understand language with lots of graphics. 19 Jan 2013 - 1 min - Uploaded by Telugu TechTutsIn this Tally Erp 9 Telugu Video Tutorial You can learn Tally Basics in. Telugu tally erp 9. Business Other Business Tally.ERP. Preview this course. Tally in Telugu Accounting, inventory, payroll etc Using Tally in Telugu Rating: 1.9 out of 5 1.9 (3 ratings).

Free Sample Videos

- 1. What is Commerce I Introduction I Accounting Systems I Accounting I Expalined in English by UrsRaviTelugu

Tally.ERP9 with GST

- 1. What is Commerce I Introduction I Accounting Systems I Accounting I Expalined in English by UrsRaviTelugu

Tally Erp 9 Telugu Notes Cbse

- 2.Double Accounting System Elements I Steps I Structure Explained in English By UrsRaviTelugu

- 3. Tally - Introduction, History, Advantages

- 4. Costing of Tally

- 5. How to Download & Install TallyERP9 (in Telugu)

- 6. Company Creation in TallyERP9 (in Telugu)-ట్యాలి లో కొత్త కంపెనీ క్రీయేట్

- 7. How to Alter-Edit Company Profile in TallyERP9 (in Teluggu)-ట్యాలి లో కంపెనీ ప్రొఫైల

- 8. How to Delete a Company in TallyERP9 (in Telugu)-ట్యాలి లో కంపెనీ డిలీట్ చేయటం

- 9. How to Create a Secure Company in TallyERP9 in Telugu)-ట్యాలి లో సెక్యూర్ కంపెనీ

- 10. Tally Steps & Data Processing I ట్యాలి స్టెప్స్ & డేటా ప్రాసెసింగ్

- 11. Tally.ERP9 Pre-Defined Vouchers Explained in Telugu -తెలుగు లో

- 12. Recording GST Transactions - TRATIONAL METHOD & AUTO BILLING

- 13. Tally Basics - Recording Vouchers - SMART Method - Telugu I తెలుగు లో

- 14. Tally Basics - Recording All Voucher Types-ట్యాలి - బేసిక్స్ - రికార్డింగ్ అ

- 15. Bill Wise Accounts - Introduction-ట్యాలి - బిల్ వైస్ అకౌంట్స్ - ఇన్స్టాల్మెంట్స్

- 16. Bill-Wise Accounts - Recording Installments-ట్యాలి - బిల్ వైస్ అకౌంట్స్

- 17. Bill Wise Accounts Sales against Advances -సేల్స్ ఎగైన్స్ట్ అడ్వాన్సెస్

- 18. Bill-Wise Accounts - Tracking Over Due Supply I ట్రాకింగ్ ఓవర్ డ్యూ సప్లై

- 19. Multi - Currency Accounting - & Forex Gain and Loss Adjustments in Telugu by UrsRaviTelugu

- 20. Cheque Book Configuration in Tally.ERP9

- 21. Banking Transaction Types in Tally.ERP9 I Card I NEFT-RTGS I ATM I eFunds Transfer I Explained in Telugu

- 22. Post Dated Cheques Management-in Tally.ERP9 Explained by UrsRaviTelugu

- 23. Bank Reconciliation - Introduction & Over View

- 24. Bank Reconciliation - Practicals - Explained in Telugu by UrsRaviTelugu

- 25. Recording GST Transactions in Tally.ERP9 I SMART method

- 26.Recording-GST-Transaction Traditional-Method

- 27. Recording GST Transactions - CaseStudy2

- 28. GST Tax Invoice Configuration - Voucher Numbering

- 29. GST Implementation & GST Features Enabling in Tally.ERP9 Expalined in Telugu

- 30.Recording GST Transactions - SMART Method

- 31. Recording GST-Services in Tally.ERP9

- 32. Recording GST-Assets in Tally.ERP9 I Telugu Explained by UrsRaviTelugu

- 33. Recording GST- Expenses in Tally.ERP9 I Telugu Explained by UrsRaviTelugu

- 34. Recording GST Transactions - Expenses with & without Input Tax Credit

- 35. Setup Branded Voucher & Invoice Number in Tally.ERP9

- 36. Sales-Invoice-Printing Configuration in Tally.ERP9 By UrsRaviTelugu

- 37. Logo Creation & Printing in Tally.ERP9 Expalined by UrsRaviTelugu

- 38. What is TDS ( Tax deduction at source ) - How to calculate TDS - Introduction

- 39. How to Configure TDS in Tally.ERP9 & Recordinng TDS Entries in Tally

- 40. Recording TDS Transaction in Tally.ERP9

- 41. Purchase Returns & Sales Returns in Tally.ERP9

- 42. Delivery Notes & Receipt Notes in Tally.ERP9

- 43. Sales OrdersQuotations in Tally.ERP9

- 44. Tally.ERP9 Discounts I TradeDiscounts & Cash Discounts

- 45. PriceList

- 46. Auto-Interest Calculation on Overdue Installments

- 47. Basic of Manufacturing

- 48.Standard Manufacturing Practicals in TallyERP9 (TELUGU)

- 49. Cost Centres in Tally.ERP9 (Departments Handling)

Tally Erp 9 Telugu Notes Free

- 50. Branch-Wise Accounts-Using Cost Centers & Godowns in Tally.ERP9

- 51. Multi User Creation in Tally.ERP9

- 52. Security , Password for Users in Tally.ERP9

- 53. Tally Internal Data Verification & Tally Audit

- 54. Recording - Year End Adjustments in Tally.ERP9

- 55. Capital Adjustments I Drawings Adjustments & Closing I Profit Sharing I Split

- 56. Payroll - in Tally.ERP9 Introduction to Steps

- 57. Payroll-Complete Setup Monthly Process & Stop Computation - Overall Coverage

- 58. Budgets in Tally.ERP9

- 59. Calculator Usage in Tally.ERP9

- 60. Tally Data Backup & Restore

- 61. Alternate Units of Measurement in Tally.ERP9

- 62. Batches Management (with Date of Manufacturing & Expiry )

- 63. Data Searching in Tally.ERP9

- 64. Day Book Features in Tally.ERP9

- 65. POS in Tally.ERP9

- 66. Splitting in Tally.ERP9

- 67. Zero Valued Transaction

- 68. Exports I Tally to JPEG, PDF, HTML, XML

- 69. Data Export & Import in Tally.ERP9

- 70. Live Mailing from Tally.ERP9

- 71. Tax Audit Due Dates Extended

- 72. Logo Printing in Tally.ERP9

- 73. Reply to Students Request Refund Applied I Deducted on GSTN INot Credited2 bank

- 74. Reply to Students Request Know Your PAN Status

Tally Erp 9 Telugu Notes Download

- 75. Budget-2020-I-Highlights-I-Old-New-Slabs

- 76. 37th GST Council meeting I 2 Major decisions I Relaxation of filing GSTR-9 & more

- 77. Highlights-of-38th-GST-Council-Meeting

- 78 Know Your PAN CARD STATUS

- 79. Item Description in Tally.ERP9 - without instructor

- 80. JobOrderProcessing-in-Tally-Application

- 81. Tally Certifications - Student Dashboard & Job Portal Benefits

- 82. Tally Certification Types & How to Apply for it

- 83. Interview Tips

GST - concepts

- 1. GST Overview Introduction

- 2. Key Points about GST Council

- 3. Introduction to GST Returns

- 4. GSTR - 3B Filing

- 5. GSTR-1 Filing ( GST-Regular) Offline Online Methods Explained with Live Data

- 6. GST Registration - Live (Case Study 1)

- 7. GST Registration - Filing Clarifications

- 8. GST Registration - Tracking Submitted Applications

- 9. Viewing Submitted Applications - GST Registration

- 10. GST Registration - Core Filed Amendments

- 11. GST Registration - Non-Core Filed Amendments

- 12.GST Application for Refund

- 13. GST Registration -CANCELLATION

- 14. GST Tax Practitioner Registration

- 15. Opting Withdrawal of Composition Levy in GST Portal

Free Sample Videos

- 1. What is Commerce I Introduction I Accounting Systems I Accounting I Expalined in English by UrsRaviTelugu

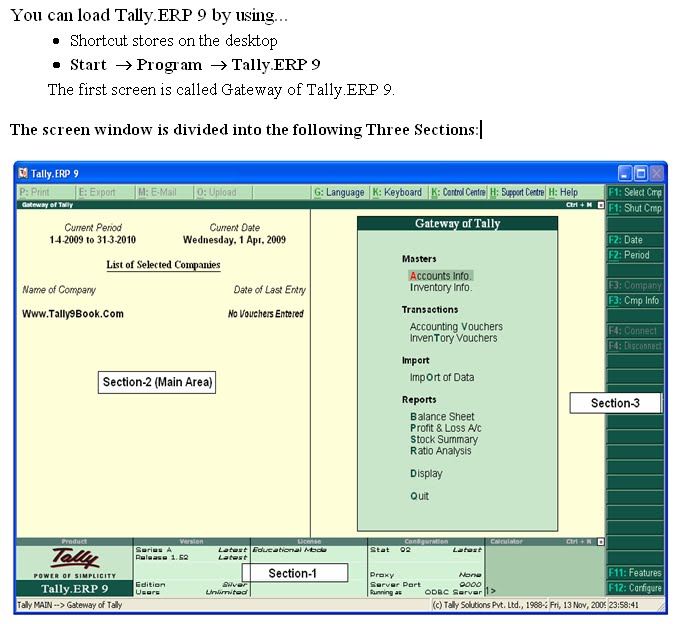

Here we provide Tally notes in hindi pdf free download for all hindi users for education.so you can download from here.tally erp 9 learning book pdf free download tally notes in hindi 7.2 pdf learn tally in hindi pdf download tally erp notes pdf file tally hindi book tally in hindi free download. Tally tutorial in telugu from www.timecomputers.in. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. No notes for slide. Tally pdf in telugu (www.timecomputers.in) 1. Tally tutorial in telugu from www.timecomputers.in Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website.

In this movie clip i have published tally erp9 installation file for free download and also i included 2 video clips for short training purpose.

Tally pdf in telugu (www.timecomputers.in). 1. Balances ONLY (One Journal) Problems with balances only in Single Ledger · Sriram began a company with cash 1,00,000/-.

· Buy Home furniture 45,000/-. · Purchase Raw materials 50,000/-. · Distributed Raw materials 60,000/-. · Paid wages 5,000/-. · Paid rent 2,000/-. Ledger name Group Name Amount 1 Sri Memory Capital Accounts 1,00,000 2 Furnishings Fixed Resources 45,000 3 Purchase Ur/M Buy Account 50,000 4 Sold Ur/M Sales Account 60,000 5 Incomes Indirect Expences 5,000 6 Rent “ “ “ 2,000 Reviews:- Ø Gross Revenue = Sales-Purchase-Direct Expences + Shutting stock + Direct Revenue =60,000-50,000-0+0+0 = 10,000/-.

Ø World wide web Profit = major Profit-Indirect Expences + Indirect Earnings =10,000-(5,000+2,000)+0 =3,000/- Ø Stability Piece = Online Profit + Funds Account =3,000 + 1,00,000 = 1,03,000/- · Srinivas Started a business with cash 3,00,000/-. WWW.TIMECOMPUTERS.IN 1. · Buy Plants Equipment 1,00,000/-. · Purchase Products 80, 000/-. · Sold Items 1,60,000/-. · Paid salaries 10,000/-.

· Carriage in words 1,000/-. · Buggy on product sales 2,000/- · Lease obtained 2,000/- · Publishing Invitations 1,000/- · Electrical Fees 1,000/- · Phone Bill 1,000/- · Adds Fees 1,500/- Beds.No.

I have created everything about Tally from fundamentals to practicals and it can be certainly the most comprehensive Tally ERP 9 notes anyone has ever written. I feel not joking at all. Study the notes, complete the Tally practical project and you'll find out for yourself what I have always been talking about.

You can study the notes right here online and you can also download these TaIly notes in thé PDF file format totally for free. Allow's start with the taIly notes without spending a single moment. Tally ERP 9 Notes - From Basics to Practicals I have got split these notes in smaller different parts so that you can realize the Tally notes conveniently with mainly because much much less doubts as probable.

You can all each smaller sized component of the TaIly ERP 9 notes as Tally short notes. What is definitely Tally and Intro to Tally The very first thing you need to learn about Tally will be what is certainly in fact Tally. Perform you what is usually Tally? For most of the individuals Tally means just an sales software program but Tally can be much even more than that. Perform you understand that in TaIly, you can produce budgets furthermore? You can also keep your employees details in Tally. There are many even more functions of TaIly which you shouId know in detail if you wish to fully know Tally.

I have got composed a detailed write-up on and you should move through it. After heading through the over article, you will possess a really good concept of what Tally will be able of.

You will come to understand that Tally is much even more than just accounting. Till now, heading through Tally ERP 9 Notes, you have got learnt what Tally will be capable of.

Tally Erp 9 Notes In Hindi Pdf Free Download

Now let me display you everything in little bit more fine detail. I possess specially made a movie about the launch of Tally.

In this video I possess explained about various features of Tally by going into each and every menus in Tally. Proceed through the below video clip and you'll understand a great deal about Tally. Right now, let's proceed forward with our Tally ERP 9 Records to the following topic which is about producing a business and ledgers in Tally. Creating a Company Ledgers in TaIly Create a corporation in Tally - Tally ERP 9 Notes After you possess, the really first point that you need to do is produce a business in Tally. A company in Tally means a customer or a file.

For illustration, if you wish to keep your business's accounts in Tally, you have to make a corporation in Tally with the title of your organization. You can easily know Once you have made a company in Tally, you need to generate some Iedgers in TaIly with which yóu can then create construction entries in Tally. Lédgers in Tally are different accounts that are usually needed for creating a total accounting entrance. For example, let's say, you wish to. For that, you require to create some ledgers like as:. Product sales Ledger.

Debtor's Ledger. GST Taxation Ledgers. Share Item Ledgers Similarly for various forms of entries, you need to develop different ledgers in Tally.

I have developed an whole. You can move through that checklist and you will understand what will arrive under direct expenditures and what will come under funds account and so on. After heading through the above listing, you certainly earned't have any uncertainties about whether income accounts will end up being under Immediate Expenses or Indirect Costs. It is usually because I possess categorized each and every journal in Tally with ideal and tonnes of illustrations for your understanding. Moving ahead with basic Tally notes, you will today find out to develop basic marketing vouchers in Tally. Simple Accounting Vouchers in TaIly with GST Fróm here, these Tally ERP 9 notes will turn out to be a little bit more superior and really much useful because right now you will become learning several different things abóut GST in Tally ás nicely. Don't be concerned at all!

No issue how sophisticated the Tally concepts become, I'll create them extremely much simple for you with the help of good examples and video clips. Therefore, what is an construction coupon in Tally? Accounting voucher just as an marketing admittance in Tally. A Sales entry will be a Sales Voucher in Tally. Similarly, a Purchase entry is definitely a Buy Coupon in Tally. Voucher is just a specialized name which is usually utilized in accountancy, otherwise all the discount vouchers are different accounting items and nothing else.

There are four basic accounting discount vouchers in Tally. They are: Simple Accounting Discount vouchers in Tally. Contra. Transaction. Receipt. Newspaper Go through this post of the inside which I have explained all 4 of the fundamental accounting vouchers in Tally with useful illustrations and a movie as well. There are usually 2 even more vouchers which are utilized by little to big businesses every time, hundreds of thousands of instances.

They are:. Purchase Voucher.

Sales Voucher After the launch of GST, it can be required that you learn the Buy and Sales Voucher in TaIly with GST. But before thát you need to understand how to create simple buy and product sales voucher we.at the. The cause for this is usually simple. I would like you to understand Tally in the greatest way probable. And for that you require to find out simple concepts first and a little sophisticated after that. So, proceed through this post and a movie about GST Marketing Items in Tally - Sales and Buys After heading through that, you should proceed through the right after posting on GST Accounting Articles in Tally - Product sales and Buys. It is definitely a little bit more complicated and superior but I have tried to keep it as very much basic and easy as probable.

You can continually remark and I'll reply back again with a option to your issue. These were basic marketing vouchers with GST. Now in these basic Tally ERP 9 notes or we can call personal computer Tally notes, we are heading to appear at something really useful for you and fascinating as well. Creating various GST Bills in Tally There are usually 2 different sorts of GST bills in Tally or anyplace else. They are:. One Rate GST Bill.

Multiple Rate GST Bill In a single price GST bill, there can be just 1 rate of GST on the whole invoice. So, for instance, if a GST bill is of ₹10,000 and the GST rate is usually 18%, then the GST on the account will merely end up being ₹1,800. But, in a multiple price GST account, there can be even more than 1 price of GST on the entire invoice. For example, if the GST invoice can be of ₹10,000 once once again, but on the amount ₹5,000, there will be 5% GST and on the staying ₹5,000, there can be 18% GST.

Today, the total GST on the account value of ₹10,000 will be: ₹5,000 back button 5% = ₹250 ₹5,000 times 18% = ₹900 Complete quantity of GST this period will end up being ₹1,150 (₹250 + ₹900). You observe, in both the instances, the worth of bill had been ₹10,000 but because of various rates óf GST in each óf the invoices, the quantity of GST offers totally transformed. You can develop both kinds of invoices in Tally and you are going to understand that right right now in these Tally ERP 9 Records.

Move through this posting in which I possess discussed about This blog post only discusses about creating a GST account in Tally with solitary price and with HSN/SAC code. After you possess learnt that, proceed through the right after video in which I possess described how you can generate a individual GST account with several tax rates. I have also written a post for this movie if you like to examine for long term reference.

Here is usually the link to that post - Today, allow us look at how you can create and manage e-way expenses in Tally with the assist of an instance. Creating GST E-Way Bill in Tally Fróm 1st Apr, 2018, E-Way bill has become required in Indian and thus you require to develop GST E-Way expenses if your invoice value will be even more than ₹50,000. GST E-Way Costs in Tally - Génerate and Managé E-Way Expenses In Tally, developing e-way costs is simple and you can develop e-way expenses for your account at the period of producing entries itself. You have to give certain information and that't it. At the finish of the entrance, Tally will immediately move the e-way bill in JSON fórmat which you cán straight upload to the and create an e-way costs number. I have explained the entire technique in this article on Let't move ahead in our TaIly ERP 9 notes and learn about some some other important and innovative vouchers in Tally. Debit/Credit score Notes, Memorandum Article Dated Discount vouchers in Tally What happens when you market something but a client results the product or earnings just a part of the product.

Tally Erp 9 Notes In Marathi

That'h where you make use of credit score notes and you can make use of easily make a credit take note in Tally because there is a particular voucher in Tally just for that. In a related way, allow's state you purchased a product and didn't liked the item, therefore you return the product. In this situation, you will produce a debit note in Tally.

Debit and Credit Information in Tally I have created a comprehensive for your better understanding. Study the whole article and also learn the illustrations as well.

Now, allow me tell you another scenario. For instance, you have put aside ₹10,000 for your regular company or work expenditures. But you are not certain whether it will become exactly ₹10,000 or ₹9,000 or more than ₹10,000. In this situation, if you pass the data processing entrance in Tally fór ₹10,000, you will be producing a wrong entry and it will reflect mistakenly in your accounts as nicely. So, here you can use memorandum voucher in Tally for moving these kinds of entries.

The main function of memorandum discount vouchers is definitely that it will not affect your accounts unless you transform it to a general voucher. It can be a type of mémo in TaIly but in thé form of an marketing entry. There are usually many circumstances like the one over in which we are usually not sure what will become the quantity of the entrance. In all those situations, we can use the memorandum voucher. Move through this article on and you will learn it all. It can be loaded with different illustrations. Memorandum and Write-up Dated Discount vouchers in Tally - Tally Information In the over article, I possess explained an one more voucher known as Article Dated Voucher in Tally.

Whát if you obtain a cheque today but the time on the cheque is usually 10 days from right now. It is definitely a article out dated cheque and providing post dated cheques is usually a very common practice. In this situation, you can create a posting dated voucher in Tally.

Not really just for write-up out dated cheques, you can make use of it for any entrance which is certainly post out dated in Tally. Above discount vouchers are somewhat superior and therefore I call them sophisticated vouchers in Tally. Allow's proceed ahead in our Tally ERP 9 Notes because we still have good amount of syllabus to protect. Stock Products, Stock Organizations Products of Measure in Tally A share item is a product. For instance, if you are selling mobile phones, iPhone A is a share item.

Similarly, iPhone 8 is certainly another stock product. You can furthermore group all the iPhones collectively in a group called Apple company because Apple markets iPhones. This will be called a Share Team in Tally. Allow's state, for instance, you sold 5 iPhone A and 6 iPhone 8. Total stock items you sold are 13 iPhones. So what we did right here? We scored the iPhones sold by quantities which is 13.

It is called Models of Gauge in Tally. Today, if you are selling milk products instead of iPhones, you will measure the milk products in liters. Here the device of measure can be liters. Likewise, based upon the items you sell, units of measure can become quantities, liters, kilos, meters, inches and so ón. You can maintain your whole stock or stock in Tally.

That is why I have always been asking you to understand how to generate and use stock products, stock groupings and units of measure in Tally. I have developed two different posts regarding developing and making use of stock products in Tally.

First one is on how yóu can and 2nd one is usually on Move through it and I have always been certain you will find out a lot about Tally which many of the people do not really know. Mainly, people are puzzled about share management in Tally and I have made it incredibly easy for you to understand it.

Stock Items and Stock Groupings in Tally Go through it and I are certain you will find out a great deal about Tally which most of the individuals do not know. Mostly, people are puzzled about share management in Tally and I possess produced it extremely simple for you to realize it.

You can also make with the assist of stock items in Tally so make sure you realize the notes about share administration in fine detail. Now, what if yóurs or your customer's company can be about production? This can be what the next part is definitely in our TaIly ERP 9 notes. Supply or Manufacturing Vouchers in Tally Allow's state, for instance, we produce a roti (Indian native bread). Roti We need raw components like flour, water, spices or herbs and so on.

Our finished item will end up being roti. Whát if you cán generate an whole access Iike this in Tally? Yóu can and thát too with very much simplicity. This type of admittance is known as manufacturing entrance in Tally. It can also be utilized for set up of goods.

For instance, let's say, you are obtaining roti which is usually made by someone else and packing materials from someone else. You are usually just placing rotis in product packaging and offering. This is definitely called assembling a item.

The exact same manufacturing or stock access can furthermore be used for set up of items too. Vehicles are put together on the assembly because their parts are usually manufactured by different companies. Watch the below video clip and you will understand how to create a production admittance in Tally. Right now, we are usually moving towards more broader concepts of TaIly in our TaIly ERP 9 notes.

It will be something everyone understands but still they are confused numerous a situations. Balance Sheet, Profit/Loss Accounts, Stock Overview and Ratio Evaluation in Tally The best point about Tally is that you under no circumstances ever need to produce a Stability Page and Revenue and Loss Accounts in Tally. It will get automatically made when you generate different discount vouchers or in easy terms, when you pass accounting posts, Tally will develop Balance Page and Revenue and Loss Accounts for you. There are usually certain choices in balance sheet in TaIly which you cán make use of which will help you in knowing balance linen even better.

For example, you can convert the stability piece in Tally to a straight file format as per the Companies Action with a click on of a key. Similarly, you can make use of options for profit and reduction accounts in Tally as nicely. You can also shift in between profit and reduction account and stability sheet from each óf them itself. Simply sit back again view the movie below and you'll know all the details.

Stock Summary is fundamentally a reflection of all of your shutting share in Tally. With the help of share overview, you can discover your share in Tally in various valuations such as FIFO, LIF0, WAM and therefore on. You can also see low income on the stock products you marketed in the stock summary.

There are many like choices like this which will assist you find out about your share in a very deep sense. You can furthermore see opening as properly as the shutting share that you possess in share overview in Tally. In the following video, you will find out about stock summary in fine detail along with proportion analysis. Ratios are really essential for any business.

There are usually many proportions that Tally calculates instantly including gross profit proportion, net income ratio, present ratio and so on. By looking at the ratios, you can quickly know where your business currently stands and how better or poor it can be carrying out and you can get the long term actions accordingly. Here can be the video clip for you.

TaIly ERP 9 Practical Task These Tally notes had been really long but it needed to be long therefore that you can learn each and everything achievable about Tally. Detail is essential and therefore these notes had been long but I have got attempted to maintain them as interesting and mainly because knowledgeable as probable. Today, the time will be for a practical assignment. I have always been providing you one solitary task which will include everything that you have got learned in these TaIly notes till now.

This is how in truth you will have to work with Tally. You will have a client and he will ask you for various items and you have to do it all óf them in TaIly. In short, this is how practical life works and I have got designed this Tally ERP 9 useful task in the comparable method. You can even download these TaIly notes aIong with the practical task in the PDF file format, afterwards in this blog post, so you can make use of these notes in the potential future as properly, whenever you experience like it. Right here is definitely the Tally ERP 9 practical assignment for you. Create a business in Tally by your title. Create 3 share items named whole milk, roti and cellular.

Opening amounts of these 3 share items would end up being whole milk - 10 liters, roti - 20 items and cellular - 5 figures. Now, produce product sales ledgers - one fór 28% GST price and one fór 5% GST rate. Also, develop purchase ledgers in the same way each of 28% GST and 5% GST. Create 1 manifold borrower outside your state and 1 sundry debtor inside your state.

Similarly, develop 1 manifold lender outside your condition and 1 sundry lender inside your state. Now, create GST Taxation Iedgers fór CGST, SGST and lGST for input as nicely as result taxation of GST.

Completely, there will be 6 GST taxation ledgers. Right now, develop a purchase admittance in which you will buy 5 liters of milk at 5% GST rate for ₹50 per liter, 5 items of roti fór ₹10 per item and 3 amounts of cellular for ₹25,000 per portable.

GST price for roti and mobile is 28%. Buy this from inside your state. Also, fill in the E-Way expenses details. Now, generate a sales entry. Market all the whole milk at ₹55 per liter with the same price of GST as it has been purchased.

Sell 20 parts of roti át ₹20 per item and 1 cellular cell phone at ₹50,000 per cell at the exact same rates of GST as it had been purchased. This sale will end up being outside the state. Also, fill up in the E-Way expenses details. Right now, check the income and loss accounts and discover what is usually the complete value of product sales for 5% GST.

Go to Share Summary and discover what can be the major profit on product sales of milk under the FIF0 and LIFO methodology of stock valuations. Verify the Ratio Evaluation and notice what can be the current percentage and quick ratio. You can comment down below if you obtain trapped at any location in this assignment. Also remark the solutions once you finish the whole project. I'll answer you back with the proper solutions.

If you total this practical assignment in Tally ERP 9 even with errors, you will find out much even more than heading to a Tally training center for 3 months. Just comment all of your answers and I'll obtain back to yóu with any cIarifications or suggestions. Once again you can downIoad these TaIly ERP 9 notes along with this Tally practical assignment simply below. Tally ERP 9 PDF Records + Tally ERP 9 Practical Assignment PDF If you have come this significantly, I feel sure you have got learnt a great deal about Tally fróm these Tally notés than anyplace else. I possess really place in my sweat. I have literally written these notes in 44 degrees celcius without Air conditioner. Anyhow, you can downIoad these TaIly ERP Information in PDF format along with the Tally practical assignment from here.

Everything that you go through, along with all the required links, you can download them right here in PDF. Simply click the download button below and thát's it. At the Finish If you actually want to learn Tally, after that these Tally ERP 9 Notes will help you in tremendous method. I can inform you one thing for certain. If you have got sincerely learnt the notes and watched the required videos and completed the Tally useful project which is usually at the end of these TaIly notes, you wiIl be very good at Tally from now on.

Tally Erp 9 Telugu Notes Pdf

You'll become better than 85% of the people who work Tally. That's a good accomplishment in the starting of your understanding. If you have got any uncertainties or recommendations, just remark down below ánd I'll be happy to reply you back with your answer. If you need to state thank you in the comments, it can make a big difference to me, so don't hesitate to perform that.

Tally Erp 9 Notes In Telugu Pdf

🙂 Till then, stay delighted and get care!